Top 10 Real Estate Investment Strategies And How is Maximising Return On Investment (ROI) in Property Investments ?

Real estate is a great investment for those who are looking to accumulate wealth and generate passive income.

In real estate Investors can approach different ways of Investment,

such as buying property directly,

taking benefit of loans, developing properties with renovations and improvements,

flipping contracts on existing properties,

making use of tax strategies related to depreciation schedules and more.

These strategies help investors to choose the best way to operate in the current market conditions.

Real estate investment strategies have been rising in popularity in recent years to make money and increase passive income.

With the help of some research it is possible to make money along with investing in real estate with attractive returns.

There are various approaches which investors can take depending on their individual goals.

So it is the most important thing to do your research before you decide on an investment strategy.

look into what methods will maximize your chances of success with limiting risk factors.

You should take advice from an experienced person when looking at potential properties, so that you understand local market conditions.

Research says that Real estate investment is becoming an increasingly popular option for many individuals over the past few years.

With the help of research if we choose the right strategies and planning, real estate can offer good returns in a limited time duration.

Many investors are obtaining maximum knowledge about buying and selling properties, leasing terms, taxation benefits, renovation costs and other important details so that they may maximize their return on investments.

Content regarding Real Estate Investment Strategies should focus on areas that allow potential investments to make good decisions when it comes to making higher returns through real estate opportunities available today.

Table of Contents

ToggleWe should understand some Real Estate Investment Strategies

1. Set Clear Investment Goals

By defining short-term and long-term objectives and establishing specific financial targets, You should align your real estate investments with your desired outcomes.

2. Conduct Market Research

Thoroughly analysing local real estate market trends, identifying emerging areas, and evaluating property demand and rental prices will guide your investment decisions.

3. Diversify Your Investment Portfolio

Spread all your investments across different properties and locations that diversifies your risk while increasing the chances for great returns.

4. Assess Risk Tolerance

After understanding your risk and financial capacity which allows you to make good decisions and implement suitable risk management strategies.

We can follow some practical Steps also to Implement Real Estate Investment Strategies

- You should set investment goals and define specific financial targets to ensure a focused approach.

- Research local real estate market trends to identify potential investment opportunities that standardize your objectives.

- Diversify your investment portfolio by considering different types of properties and exploring various locations.

- Analyse risk management with each investment option and find strategies accordingly to balance risk and reward.

- You should take guidance from real estate professionals or experienced investors who can provide valuable advice.

- Continuously monitor and evaluate the performance of your investments and make necessary adjustments according to requirement.

- Get in touch with changing market trends in real estate and adapt your strategies accordingly to maximize ROI.

By implementing these real estate investment strategies, you can enhance your chances to achieve maximum ROI and get more in property investments.

Remember, each investment carries its own risks, and it is crucial to conduct thorough due diligence and seek professional advice when entering the real estate market.

In real estate it is saying that stay informed, stay proactive, and maximize your real estate investment opportunities.

Some Effective Real Estate Investment Strategies For The Persons Who Are Beginners In Real Estate

It is well known that real estate investment can be a profitable way to build wealth and create passive income.

However, for beginners, navigating the world of real estate investing can be immense.

That’s why having a solid investment strategy is crucial.

In this blog post, we’ll discuss five effective real estate investment strategies that are perfect for beginners.

Whether you’re looking for long-term appreciation or short term returns, there’s a strategy for you.

1. Buy and Hold Strategy

The buy and hold strategy is one of the most common and popular real estate investment strategies.

With this approach, investors purchase properties with the intention of holding them for the long term.

The main goal is to generate rental income and benefit from property value appreciation at a time.

By carefully researching the market and selecting properties in high-demand rental areas, investors can enjoy a passive income and potential wealth.

So a person can generate rental income for short term as well as long term.

With a buy and hold strategy for long-term, property value appreciation can be possible.

In spite of that tax benefits, including depreciation will be deducted.

The responsibility increases related to property management and getting in touch with latest market research.

But Market fluctuations can impact property values.

It Requires a longer investment horizon to enjoy a passive income.

2. Property Flipping

The house flipping strategy involves purchasing properties that require renovations or repairs at a lower price, completing the necessary improvements, and then selling the property at a higher price.

Successful implementation of this strategy requires a strong understanding of market trends, the ability to accurately estimate renovation costs, and a reliable network of contractors.

With high-profit potential, fix and flip projects can rapidly increase an investor’s capital, making it an attractive option for those seeking quick returns.

Almost 90 per cent of the world’s millionaires made their wealth through some type of real estate investing.

If you want to maximize your profits with real estate investing, then flipping houses is a good strategy to pursue.

So in simple words we can say the idea or flipping houses’ meaning is simple; you either buy a home anticipating a quick rise in the value of the house, and sell it as soon as you get your expected profit.

So it is best to buy a property that is priced below the market value.

Your job as a flipper is to find motivated sellers who are keen and desperate to sell as fast as possible.

Flipping properties can be profitable and help earn decent returns on investment, especially for those who are quick and have better knowledge of market trends and always do their due-diligence.

But it can also be quite risky for the persons who are uninformed about the latest trends,” says Santhosh Kumar, vice-chairman, ANAROCK Property Consultants.

Property flipping is having a Potential for rapid profit in the long term as well as short term.

You have an active and hands-on approach to real estate investing.

A person should have creative opportunities to add value through renovations.

But you have some challenges as well with property flipping like you require a strong knowledge of local market trends otherwise you will face losses.

Flipping of property is speculative in nature.

The return on investment is dependent on short-term capital gain.

A stagnant property market or a lack of demand could delay your flip.

Further, the risk could be compounded if the developer is unable to complete the project in time.

Is Property Flipping in India profitable?

“Property flipping in India is a rather obscure concept that is limited to only a few investors as against developed markets where it is fairly common.

The challenge in our country however is that, “A large quantity of properties is sold during the under-construction stage.

Flipping is generally not permitted at this stage.

However, once the Occupancy Certificate (OC) is received, there is no problem in resale,” says Subhankar Mitra, managing director, advisory (India), Colliers International.

“There are instances where investors had purchased properties at the ‘pre-launch’ stage at a discount of 25-30 percent and made attractive returns after completion of the project,” adds Mitra.

“However, a delay in possession could harm your investment.

It is thus crucial that you invest in a property by an established developer with a good track-record, which is also registered by the Real Estate Regulatory Authority (RERA) registered.

While it can be quite profitable if done right, it is a risky prospect. To earn maximum returns, it is always advisable to seek professional help,” says Kumar.

Kindly Refer the you tube video Of Times of India for detail:- https://youtu.be/XvXOcgVvPQ8

Wholesaling

Real estate wholesaling is a strategy in which a wholesaler obtains a contract on a property with its seller, and in turn sells the contract to an investor.

Real estate wholesalers are always looking for distressed properties priced below market rate.

These distressed properties are put under contract, and then assigned to another investor for a fee.

This strategy requires effective negotiation skills and a network of potential buyers.

These types of properties usually need quite a bit of work to renovate , and the owner is often motivated to sell and isn’t interested in working with a real estate agent.

Wholesaling in real estate is nothing but like investing in stocks and bonds.

In real estate transactions can be tricky to navigate and they often come with a heavy price tag.

If you’re interested in becoming a real estate investor but you don’t have enough capital to invest , wholesaling real estate may be a good option for you.

With the help of wholesaling strategy you can easily gets entry to started as a real estate investor

If You are having Low upfront investment to begin with you can start investing, so it’s a low-risk way to get started as an investor.

You can refer for more detail about Real Estate Risk Management

It is a quick turnaround and potential process for fast profits and you have the opportunity to close real estate deals in any market.

Minimal property ownership responsibilities Considerations.

You have got an opportunity to make a large profit in a short period of time.

But in wholesaling you require a solid understanding of the local market and investor preferences.

You should spend time researching the markets in which you’re interested in buying a property.

For instance, you can take help resources, like Rocket Homes Real Estate LLC to research specific neighborhoods you’re looking to buy in.

You should also spend time finding motivated sellers that can be very challenging.

But it is an unpredictable market, as profit will be depending on the availability of the market.

It will take time to be successful and start earning a profit as a wholesaler.

So you can say that it has Limited long-term income potential compared to rental properties.

Wholesaling property is different from property flipping because when you flip a house, you purchase a property that needs some work and spend time fixing it up.

And once you’ve increased the value of the home, you can sell it to make a profit.

With wholesaling, you’re still buying a distressed property, but you’re not doing the work to fix it up yourself.

Real Estate Investment Trusts (REITs):

REITs are companies that own, operate, or finance income-generating real estate assets.

Investors can buy shares of REITs on stock exchanges, allowing them to invest in real estate without directly owning properties.

Investing in real estate investment trusts (REITs) offers an alternative approach to traditional property ownership.

REITs are companies that own and manage income-generating properties, such as shopping centers, apartments, or office buildings.

Investing in REITs allows individuals to have a diversified real estate portfolio but there is no need for direct property ownership.

REITs often provide regular dividend payments and the opportunity to benefit from property value appreciation.

We have some different types of REITs you can see below:

1. Equity :-

Typically, it is concerned with operating and managing income-generating commercial properties.

2. Mortgage:-

Also known as mREITs, it is mostly involved with lending money to proprietors and extending mortgage facilities.

3. Hybrid:-

This option allows investors to diversify their portfolio by parking their funds in both mortgage REITs and equity REITs.

4. Private REITs:-

These trusts function as private placements, which cater to only a selective list of investors.

So this type of REITs are not traded on National Securities Exchanges and are not registered with the SEBI.

5. Publicly traded REITs

Publicly-traded real estate investment trusts extend shares that are enlisted on the National Securities Exchange and are regulated by SEBI.

6. Public non-traded REITs

These are non-listed REITs which are registered with the SEBI. However, they are not traded on the National Stock Exchange.

Kindle get More detail about REIT with https://groww.in/p/real-estate-investment-trust-reit

So RIET gives Access to diversified real estate portfolios to their investors.

In RIET you can purchase Liquidity: and can sell Shares like stocks.

You can Receive Passive investment with professional management.

Rental Properties

Purchasing properties with the primary goal of renting them out to tenants.

Buying one rental property is a strategy used by investors who want to regularly expand their rental businesses.

Buying one property per year is an easy way for investors to slowly expand their rental income instead of buying multiple properties at once.

Rental income can provide a steady cash flow and potential for property appreciation.

An excellent strategy for a Investor to buy one rental property who wants to put in the work.

After all, if you buy the property for the purpose of rent, you become a landlord with several responsibilities.

If you already have several rental properties and you need help managing them, contact your local Baltimore rental property management company.

It provides you with a Consistent rental income.

If you own Property that can lead to long-term wealth accumulation.

But it increases a lot of challenges like tenant screening and management.

Moreover , Market fluctuations can impact rental demand and property values as well.

You can refer more about rental property at: https://www.investopedia.com/articles/investing/090815/buying-your-first-investment-property-top-10-tips.asp

Short-Term Rentals (Airbnb and Vacation Rentals):

The Airbnb is an investment strategy in which individuals or real estate investors purchase properties with the primary aim of listing them on Airbnb as vacation rentals.

Basically, an Airbnb property refers to any residential space, be it an entire home, a single room within a home, or a unique accommodation like a treehouse , which is listed on the Airbnb platform for temporary lodging.

The Airbnb strategy is a crucial asset for real estate investors and short-term rental hosts because running an Airbnb can be a great source of passive income.

With good planning and management, a short-term rental property has the potential to generate significant profits.

Airbnb rentals can generate higher returns than traditional rentals due to the flexibility to charge higher rates per night, especially during peak travel seasons or in desirable locations.

Additionally, Airbnb hosts can set and adjust their own rates, giving them a level of control over their potential earnings not typically seen in conventional rental properties.

They can also enforce their own rules and regulations for the property

Renting out properties on short-term platforms like Airbnb for travellers seeking temporary accommodations.

This strategy can provide higher rental income but requires active management.

It has potential for higher rental income compared to traditional long-term rentals.

they can offer a higher rate of return compared to conventional rental properties.

Airbnb investments provide a great source of passive income and once it is set with the help of management the day-to-day operations can take place quite smoothly.

It is flexible to use the property for personal stays.

Lots of travellers have an Access to a growing market.

Commercial Real Estate

When talking about commercial real estate investment strategies, we come to know four main approaches: like core, core plus, value added, and opportunistic.

All of the above investment strategies are not basically different from each other–in all cases, because all investors buy properties with the goal of generating returns.

Investing in commercial properties, such as office buildings, retail spaces, and industrial properties.

Commercial real estate can also offer higher rental income and have potential for long-term lease agreements

All commercial properties are basically based on leased to businesses that pay rent on a monthly basis that provides a stable income for their property owners.

The value of commercial property always increases because it is more desirable and the surrounding area develops.

It Gives Higher rental income as compared to residential properties.

Basically commercial property is taken by tenants for Longer lease terms so it has more stability.

In commercial Property investors can diversify their profits.

But in commercial properties Larger upfront investment is taken as compared to residential properties.

And tenant turnover may take longer in commercial properties.

Market demand and economic factors in commercial property may influence occupancy rates.

Private Lending

In the past, real estate financing typically came from banks, government agencies, insurance companies, and pension funds.

But now, private money lending is a very crucial component of the real estate investment industry.

In fact, we can say its existence makes it more possible for the average investor to run and maintain a sustainable career.

As private loans become an easy factor , investors can easily establish private lending companies.

Many private lending companies are groups of investors who pool their capital to finance more deals, and increase their profits.

In real estate private investors have a great source of capital for new construction projects.

In many cases the private investors will provide up to 50% of the purchase cost for the land and up to 100% of the construction costs.

After the completion of project construction investors can either sell the property and repay the loan, or refinance and hold the property as a low maintenance rental property.

Acting as a private lender by providing loans to real estate investors or developers.

Private lending offers the opportunity to earn interest income on loan repayments.

Benefits:

So as we understand that private landing provides passive investment with fixed interest income.

It will be Collateralised by real estate assets.

Potential for regular, predictable returns.

Crowdfunding and Syndication

An overview On Syndication :

Syndication is the process of forming the real estate investors group who pool together and join financial and intellectual resources to invest in a large property deal.

Investors Contribute their capital to purchase and operate in real estate.

Syndicates are always responsible to handle their property acquisition ,management and their own decision making.

In this process syndicates join/ create a syndication led by an expert professional in real estate.

Syndicates always have an exit plan with which they can sell their property after a certain period.

A real estate syndicate has to become registered as a legal entity such as an LLC or LP, as per the Securities and Exchange Commission (SEC) regulations.

Investing in real estate projects alongside other investors through online platforms.

This strategy allows individuals to pool their resources for larger-scale investments.

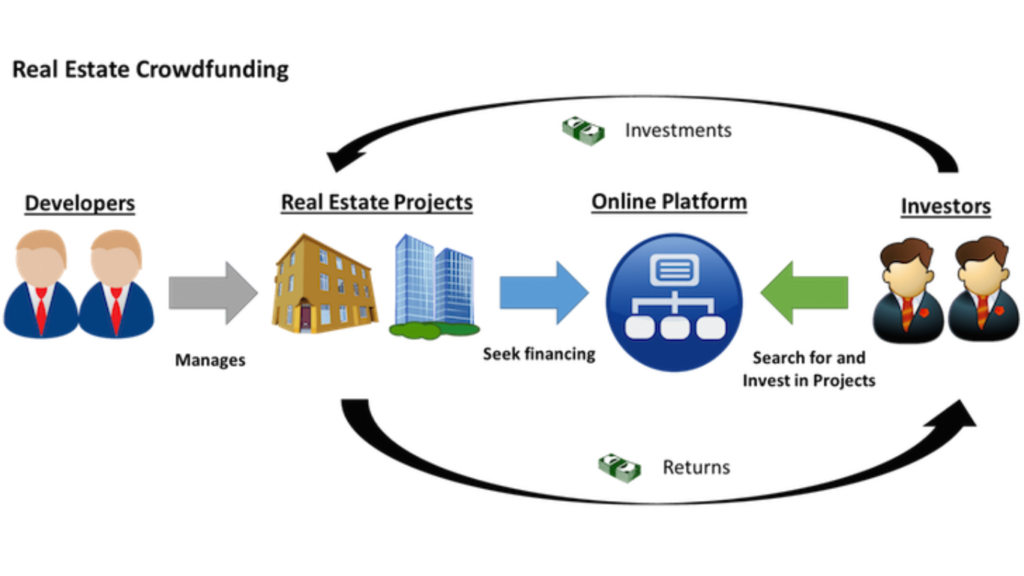

An overview on Crowdfunding:

Real estate crowdfunding is a niched form of alternative financing.

The main aim of crowdfunding is to attract investors with sufficient capital to participate in various property investments.

Crowding refers to that process in which real estate experts connect with would-be investors for large scale investments.

Real Estate professionals select an investment opportunity and contribute funds according to investors’ budget.

In crowdfunding exit strategy is dependent on the project, investors may receive returns with regular distribution or project completion.

In this process projects are always available on residential, commercial, or development platform.

Regarding real estate syndicates, sponsors can get in touch with potential investors through real estate crowdfunding platforms.

1031 Exchange:

1031 is a provision of the Internal Revenue Code (IRC) that allows a business or the owners of investment property to defer federal taxes on some exchanges of real estate.

A 1031 is also known as “like-kind exchange” or “tax-deferred exchange”.

The primary purpose of 1031 exchange is to promote investment in real estate by providing investors with the tax benefit.

It also allows reinvesting their profits into new properties, in spite of cashing out and paying taxes on cash.

To qualify for a 1031 Exchange, both the property has to be sold and purchased for the purpose of investment, business, or productivity being done only for trade or business.

A 1031 exchange allows investors to defer capital gains taxes by reinvesting the proceeds from the sale of one property into the purchase of another like-kind property.

In 1031 exchange the consultation with tax and legal professionals is very crucial to understand.

It has an ability to leverage property appreciation for future investments.

There are some strict rules and timelines that must be followed to qualify for the 1031 exchange.

Conclusion

How to choose the right real estate investment strategy totally depends on investors financial goals, risk tolerance, and expertise.

Each strategy has its own set of benefits and considerations.

So it is important to do research with the market and assess your options.

Whether you’re interested in generating rental income, flipping properties for quick profits, or diversifying your portfolio through REITs.

Real estate investment offers maximum opportunities to achieve your financial goal and make your short term and long term profit.

Always remember to conduct industry research, get in touch with expert advice when necessary, and stay informed about market trends to make profitable investment decisions.

Real estate investment provides various strategies for beginners by which you can take benefits to enter the market successfully.

Whatever your goal is like, long-term appreciation, quick returns, or passive income, these strategies always help you to achieve your investment goals.

With the help of research, and understanding market conditions play critical roles in implementing any real estate investment strategy.

Start small, learn from experienced investors, and continuously educate yourself to grow as a real estate investor.

Leave a Reply